Celebrating 10 years of operation in June 2017

June 2017 marks 10 years of operation. To all my clients, past and present, current and former employees, I would like to thank you on your support. It has been an absolute pleasure to work [...]

Tax cuts – withholding amounts changed

The Australian Government has increased the 32.5% tax threshold from $37,001 - $80,000 to $37,001 - $87,000. What does this mean for employers? The tax tables have changed for employees who earn over $80,000. You [...]

Do your provide taxi travel through ride-sourcing? If so, you must register for GST regardless of turnover.

See following a recent ATO post on this topic: Providing taxi travel services through ride-sourcing and your tax obligations. The views in this product relate to the meaning of the word ‘taxi’ as it appears [...]

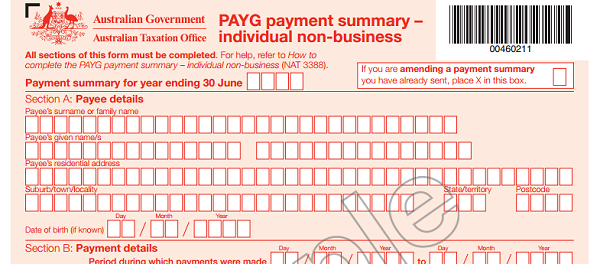

Have you issued your 2015 Payment Summaries?

Payment Summaries should have been issued to your employees by now and you have until 14th of August to report to the ATO. Accounts Central Services has now issued payment summaries to all its clients [...]

Are you having trouble juggling your family life and your bookkeeping?

Then give us a call at Accounts Central Services on 03 9614 8641 and to discuss your business bookkeeping needs and free up some of your precious time to spend with your family. As it [...]

Have you completed your BAS for the March 2015 quarter?

It is due today. However if you use a BAS agent or Tax Agent to lodge your BAS you will receive an automatic extension for lodgement and payment until 26th May 2015. Should you need [...]